The ReFi space is in dire need of metrics that can define its success. Their absence continues to have a negative impact, particularly on funding opportunities. On one hand, it escalates the notion that ReFi lacks sustainable commercial models, making it more difficult for projects to raise funds. On the other, donors are fatigued because there are no clear indicators to show the purposeful and sustainable use of their donations. With projects often having to choose between impact and financial returns, getting outside capital into the space has become an Herculean task. There have even been existential questions about ReFi's very essence.

ReFi is at a point where it must continuously prove its worth to entities like governments, investors, climate finance institutions, and crypto natives. This is to be expected when a space suffers from low funding, lack of ROI, and relatively little success. You might wish to argue the point about success, but the reality is we don't have a way to truly understand whether what we're doing as a collective is successful in the eyes of others. We can aggregate individual project output in terms of reductive metrics like green energy generated, but does that go far enough? No! To me, the ideal success metrics accurately describe ReFi's success beyond reductive metrics.

Easier said than done, and not at all like creating success metrics for a single project. One roadblock is that we have yet to agree on a shared definition of what ReFi is. This convolutes the metrics development process. Unlike decentralised finance (DeFi), where there is a clear definition and metrics like total value locked and transaction volume, ReFi is more complicated because on-chain activity leads to off-chain impact and vice versa. With this in mind, I decided to search for a metrics set that could truly define ReFi's success.

Why ReFi needs success metrics

We need metrics because we won’t be taken seriously without them. They provide an authority, credibility, and authenticity that we are currently missing. My sense is that ReFi projects would have a much easier time pitching to investors. Just as donors would have a better sense of the impact they are contributing to.

Consider the case of impact DePIN projects like M3tering and Arkreen. On the surface, they are enabling the expansion of solar energy production. These projects could define their success in terms of solar energy generated and leave it at that. The main issue I see with this approach is that such a reductive metric misses out on what's happening beneath the surface. The real impact of solar energy generation on communities, in other words. Things like economic development, regenerative flywheels, and new incentive frameworks. These metrics would tell a much stronger story.

Shared success metrics will also help individual projects align their own milestones. Using the above example, impact DePIN projects would have a brighter North Star to aim for. A classic case of the sum being greater than the parts.

Finally, we need success metrics to help counter negative perspectives of ReFi's worth. While researching for this article, I came across no fewer than eight articles questioning whether ReFi offered any value. It would be a lot easier to restore confidence and shape future narratives if we had a shared way to define ReFi's success.

My own quest

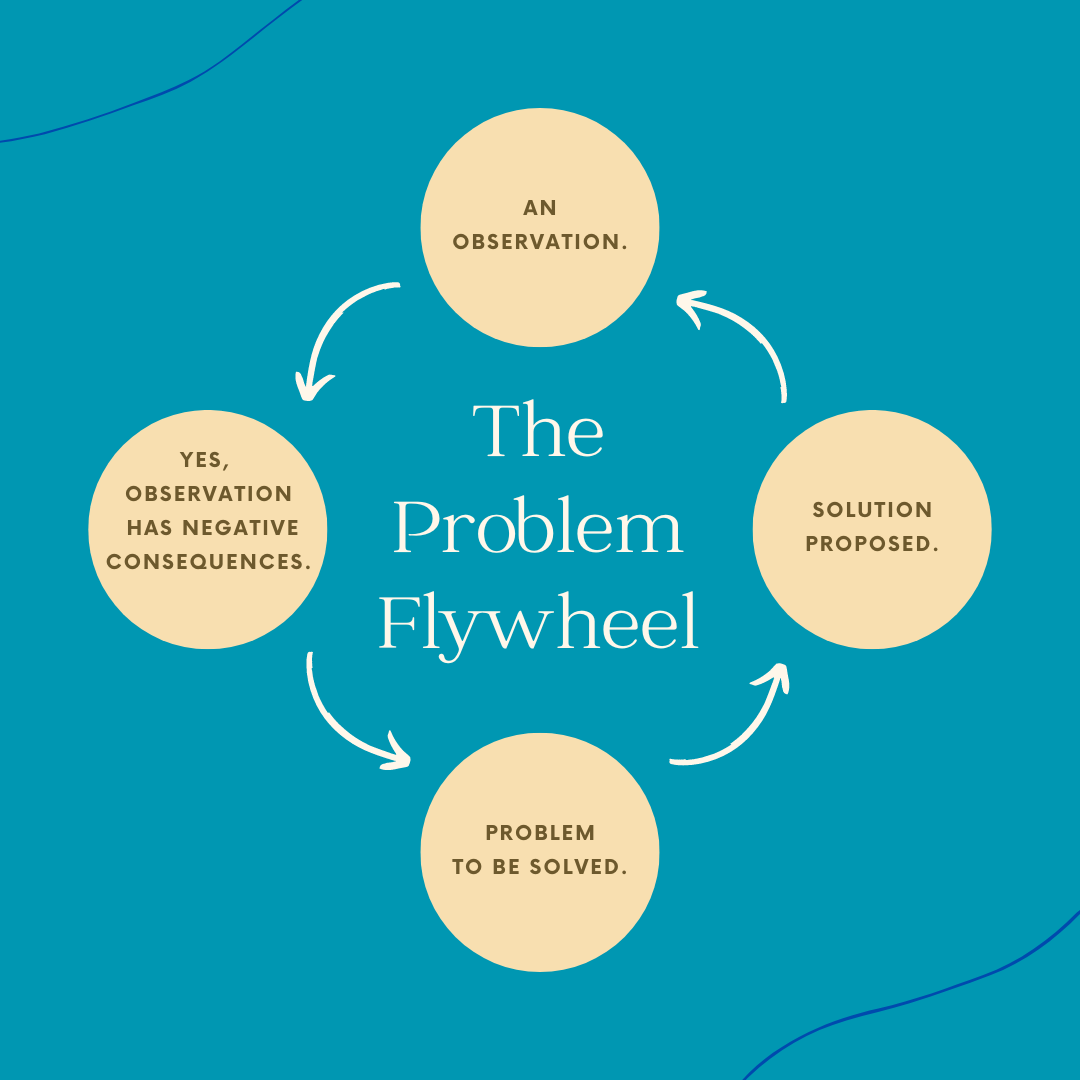

I attempted to create a set of ReFi success metrics to complete the problem flywheel I had spun. I was looking to develop quantitative metrics that were completely unique to ReFi, made sense without context, were super useful, and could translate qualitative impact to figures. Most importantly, I wanted to create metrics that would immediately have good numbers. In retrospect, I asked for too much.

For my attempt, I used CARBON Copy’s definition of ReFi: a collective of projects using Web3 to incentivise ecological/social impact. Plan A was to use a top-down approach combining impact investing metrics with Web3 metrics. Plan B was to develop metrics for each category and stare at them until I discovered an overlap.

Plan A

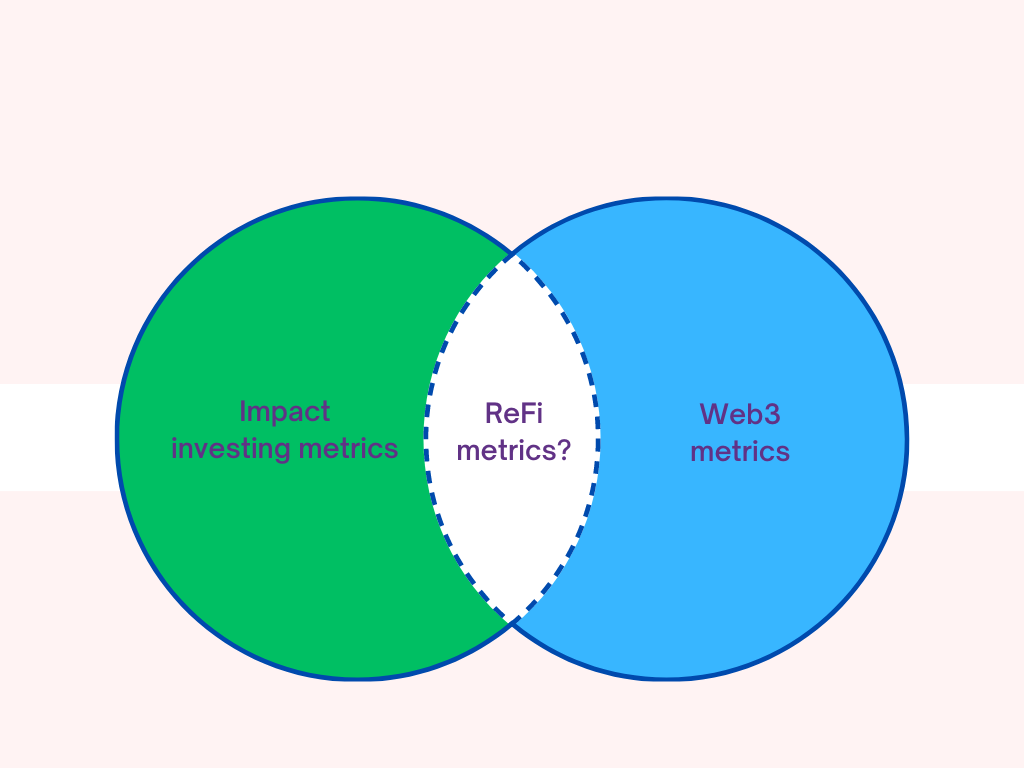

When I was writing the overview on ReFi investment instrument projects, I was forced to understand the difference between investing in ReFi, impact investing, and instruments for retail investors. From that moment, the thought that ReFi is at the intersection of Web3 and impact investing stuck in my head.

I decided to test that notion. I got over 700+ metrics from the IRIS+ metrics catalogue of impact investing. The Global Impact Investing Network developed this metric set to handle measurement complexities associated with impact investing. Interestingly, it has a metric set for each sustainable development goal. I then compiled a list of common Web3 metrics such as monthly active users (MAUs), unique wallets, at-risk wallets, new wallet signups, and transaction value enabled.

Finally, I created a mathematical relationship between both sets and analysed each member for about five minutes. This produced metrics like energy generated by active wallets, waste recycled by active wallets, and transaction value enabled by trading onchain ecological credits.

Unfortunately, a majority of the metrics didn’t meet my criteria. For example, transaction value enabled by trading on-chain ecological credits isn’t meaningful without context. The major flaw I found was that the methodology assumed every ReFi project had some on-chain value attached to its impact. For example, if the only on-chain value a regenerative agriculture project has is the amount of Web3 grant funding received, it doesn’t make it less of a ReFi project than an on-chain ecological credit protocol.

Plan B

Plan B turned out to be simpler than Plan A. Starting with the Impact NFT category from our ReFi taxonomy, I developed individual metric sets for Ecosapiens and plant-based. I then created an overlap set, called "eco-plant" with shared metrics such as number of NFTs held, NFT sales volume, and tonnes of carbon removed.

When I had created all of the overlap sets for all possible combinations, I compared them. The final category metric set had elements like total amount of money raised through NFT sales, number of NFTs sold, number of unique wallets participating in an NFT project, and number of repeat NFT buyers.

The flaw in this methodology was that I couldn’t develop overlapping metrics across all categories. Due to time limits, I ended this process with 26 disjointed category sets and one overlapping set obtained from combining the solutions developer, project financing, and fundraising sets. My problem with these category metrics was their insignificance in the grand scheme of things. We develop metrics to measure available data, but this methodology created metrics for data that wasn't available.

Finding clarity

I spent a 100+ hours trying to develop metrics that were unified even to the smallest degree. While I didn’t succeed, I didn't exactly fail either. This is my first step in a journey of continuous reiteration and I have learnt the following from the flaws of previous ideation.

One thing I've learned is that it's easy to create a metric. What's difficult is creating one that is useful, significant, makes sense without context, and can accurately measure quantitative and qualitative impact. On qualitative impact, we can modify the Impact Multiple of Money (IMM) model to measure qualitative impact in terms of the dollar or preferably, USDGLO e.g the dollar impact of rewilding or conservation.

ReFi is continuously evolving. Our ReFi taxonomy already has 29 categories with over 250 projects. The bigger it grows, the harder it becomes to strike a balance between tightly detailed and loosely universal metrics. The best time to start was in 2021; the second best time is now. I urge every thought leader, builder, researcher, and enthusiast to join hands in this inaugural attempt for the standardisation of success in the ReFi space.

This article represents the opinion of the author(s) and does not necessarily reflect the editorial stance of CARBON Copy.