A Deep Dive into the Economics of ReFi X-to-Earn Projects

Trinity Morphy explores the X-to-Earn concept, its potential for financial and impact sustainability, and possible revenue models.

By Trinity Morphy | April 15th, 2025

The X-to-Earn (X2E) model, where "X" represents a type of activity, gained significant traction as crypto became popular. Initially popularised by "play-to-earn" (P2E) blockchain games, this concept demonstrated the ability of direct incentives to stimulate user adoption. Recognising this potential, ReFi builders adapted the X2E framework to reward individuals and communities for things like tree-planting, cleaning, moving, and participation in sustainable practices. After many attempts, the big problem is that these projects lack financial and impact sustainability.

Approximately 30 X2E projects exist in ReFi, including DeCleanup Network, Recy Network, and WAYST, to reward users for completing ecological and social impact activities. However, a critical challenge persists: there isn't a consistent revenue model to sustain the incentives. In other words, projects deplete their funds without a reliable mechanism for replenishment. While the allure of direct compensation in ReFi X2E projects drives initial user adoption, sustaining operations remains a significant hurdle. In this article, I aim to provide a deep analysis of the economic and impact challenges confronting these ReFi X2E projects and propose viable pathways forward.

The economics of X2E projects

To understand the economic challenges faced by ReFi X2E projects, we’ll explore their three main phases: initial funding, rewards, and revenue.

Initial funding

ReFi X2E projects typically generate funding ahead of their launch through one of three common methods: grants, self-funding, and token launches. Some secure Web3 grants from platforms like Gitcoin or from foundations within the ecosystems they’re building on. Others rely on self-funding while hoping to attract additional support from crypto-native investors. Finally, some projects opt to launch their own token, raising funds through retail participation and community buy-ins.

Grants can help fund the early stages of a project, but they often come with strict rules and reporting demands that reduce flexibility and may slow things down. Self-funding gives more freedom, but limits how big the project can grow, since it's tied to personal or internal resources. Token launches can raise a lot of money, but they depend on market conditions and face legal risks, which can affect the project’s stability and raise questions about its legitimacy.

Rewards

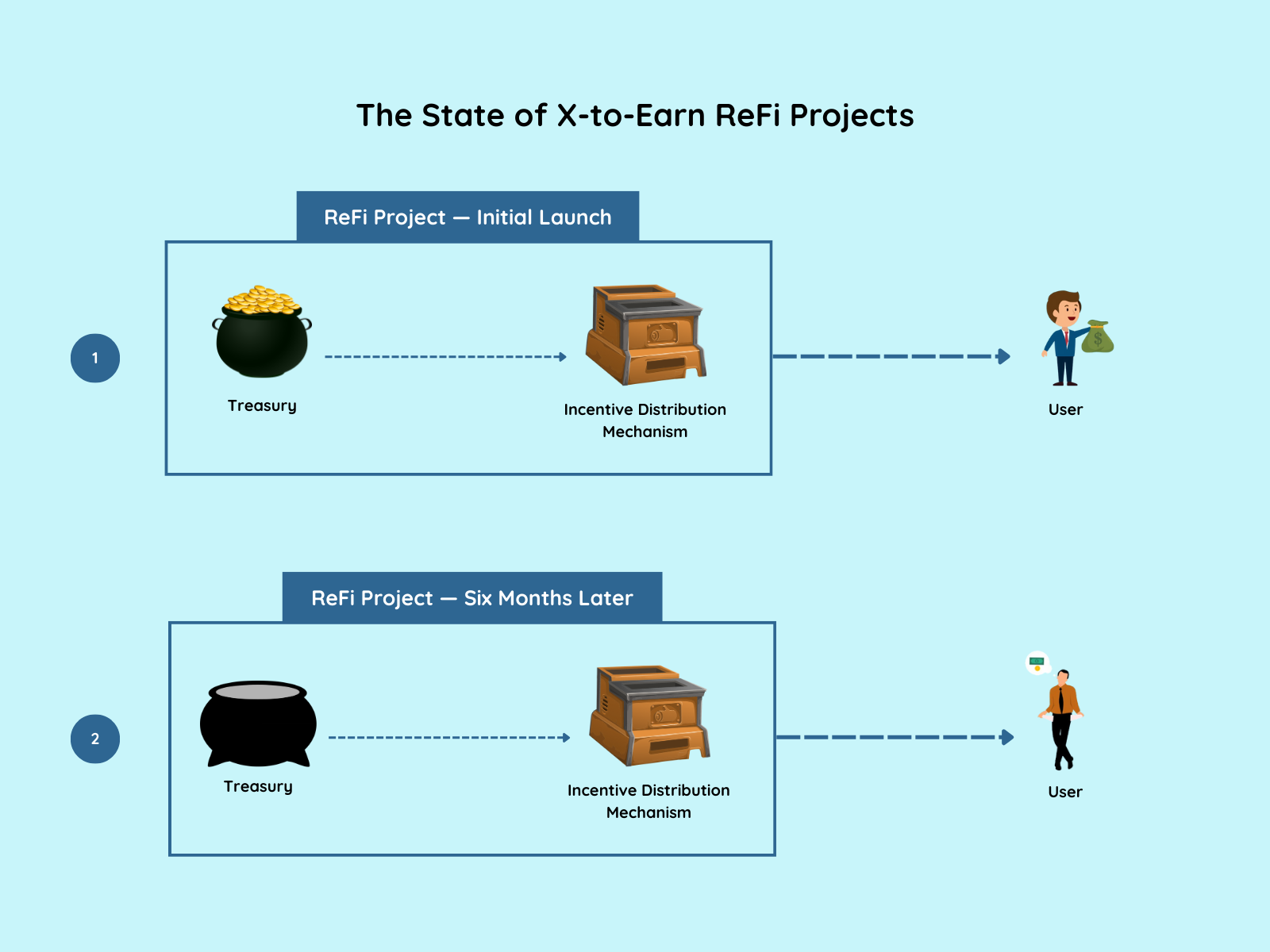

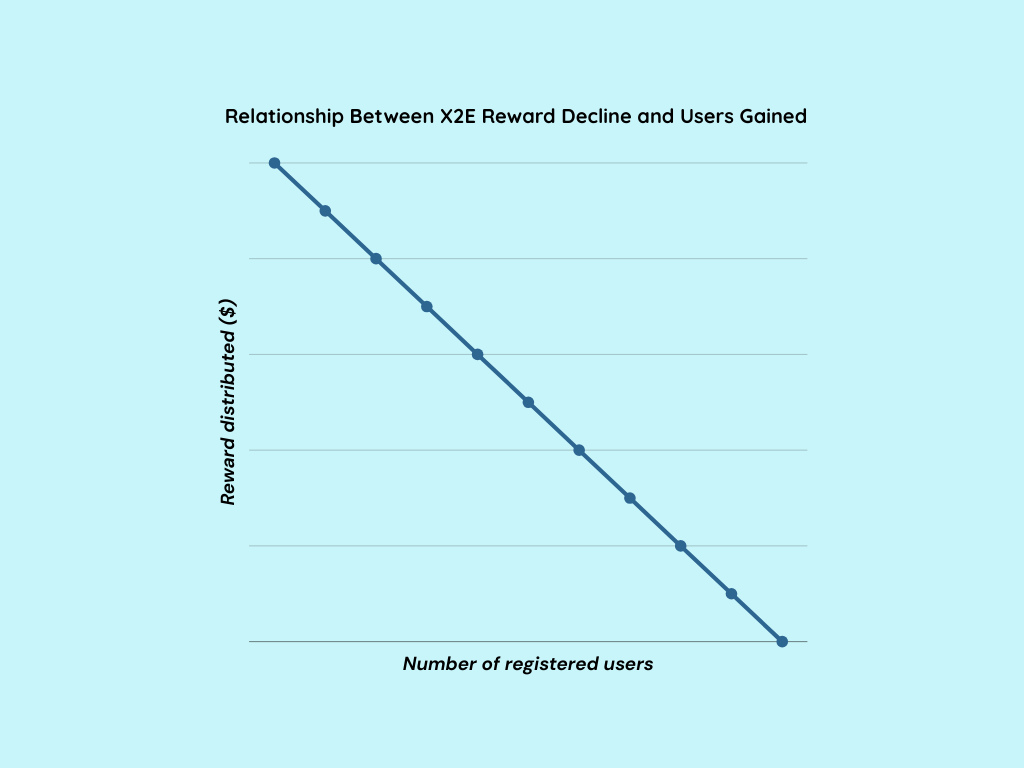

Most ReFi X2E projects have a one-way rewards system: from the project to the user. As shown in the first illustration, rewards flow out of the project’s treasury to users upon launch, typically without any mechanism for replenishment. As more users get onboarded, the rewards distributed gradually reduce to sustain the treasury. At this point, some users may have grown dependent on the rewards they generate from the project as supplementary income. Without replenishment, the treasury will get empty no matter the reduction in reward amount. For some, it could be within six months and for others, it could be after a year. Without any self-sustaining revenue streams, ReFi X2E projects are 101% sure to kiss the dust.

Revenue

The core value proposition of ReFi X2E projects is that users execute impact activities and receive tangible rewards in return. How does this value proposition fit into the 10 most popular revenue models? For easier understanding, I further categorised the discussed models into their underlying revenue streams.

User-based models

User-based revenue models seek to generate revenue directly from the users of the X2E project. There are three major models used here: transactional, subscription, and freemium. The transactional model has to do with a potential user making a one-off payment as an investment for long-term income generation. With the subscription model, users make recurring payments to keep using the platform. The freemium model offers basic features of the X2E projects for free and paywalls major features that would allow users to gain the most out of the platform.

A general problem with this model is that they exclude the less wealthy members of the population whereas they are more likely to use the platform to earn. Utilising the transactional revenue model in an X2E project introduces the challenge of determining appropriate pricing that doesn't discourage participation. There are high chances of subscription fatigue with subscription models. Teams would have a tough time determining which features should stay basic and which should go premium in the freemium model.

User revenue models that charge individuals for carrying out impact activities only to later reward them are fundamentally flawed and counterintuitive. They contradict the "earn" premise, as users are unlikely to pay for uncertain returns, and incentivize gaming the system over genuine impact. As earnings decrease, users will likely abandon the platform, rendering it unsustainable.

Institutional models

Institutional revenue models seek to generate revenue primarily from businesses, organizations, governments, or other institutions rather than individual users by offering them a service based on activity metrics of the X2E platform. They include ads, affiliate marketing, channel sales, and marketplace commission.

In the ads model, the project displays environmentally conscious advertisements on their platform and earns revenue. Affiliate marketing enables the sustainability-focused creators or websites to promote eco-friendly products and earn a commission for each sale or lead they generate. Channel sales involve distributing the X2E product through NGOs and social enterprises. In a marketplace commission model, the project connects buyers with sustainable brands or services and takes a percentage of each transaction as revenue.

The ad model faces the challenge of attracting enough sustainability-focused advertisers. With the affiliate model, there’s the problem of promoting consumption within a system designed to reduce environmental impact, leading to user skepticism. Major challenge of the channel sales model would be identifying technologically capable partners and negotiating fair revenue splits. The commission marketplace model has the problem of establishing pricing models that accurately reflect the value of various impact tasks.

Institutional revenue models for X2E models are very much reliant on the number of active users as well as daily activity logged on the platform. It could take years to achieve the figures these entities look for before partnering and these X2E products are likely to have failed before then.

Hybrid model

A hybrid revenue model generates revenue from both users and institutions and a typical example is the donation revenue model. With the donation revenue model, X2E products get donations and grants from users and institutions alike that are quite appreciative of the work done. The problem with this model is that it suffers from unpredictable revenue streams and is susceptible to donor fatigue. With every donation cycle, the project has to create a unique donation value proposition that would spur people to donate.

After analysing these revenue models for ReFi X2E projects, none of them are likely to generate enough revenue to pay each user at least $100 a month–the base amount revealed in a Mastercard survey that people would need to earn to consistently use these platforms.

The impact of ReFi X2E projects

Apart from the financial unsustainability, another thing that bothers me most is the impact of these projects. It is one thing to incentivise sustainable outcomes, it is a different ballgame to design the outcome in a way that leads to sustainable impact.

The following table details various X2E model types, the short-term activities they incentivize, and the associated impact limitations. It also proposes alternative, long-term activities based on these models, emphasizing their potential for greater impact.

| Model | Short-term approach | Impact limitations | Long-term approach | Sustainable impact potential |

|---|---|---|---|---|

| Clean | Incentivise users to clean their immediate environment | Cleanliness is temporary; locations likely get dirty again within hours due to human activity | Incentivise users to mount dustbins in places without them | More sustainable impact through permanent infrastructure that addresses root causes |

| Learn | Reward users for engaging with educational content on environmental topics | Knowledge may be short-lived if not applied; users may forget or disengage over time | Incentivise learning and consistent application of nutritional knowledge or growing healthy food | Creates lasting behavioral change through practical application of environmental knowledge |

| Health eating | Incentivise consumption of nutritious foods | Health benefits are temporary; single healthy meal can be negated by unhealthy choices later | Guide users to apply knowledge through activities like home composting or joining conservation efforts | Develops sustainable dietary habits and potentially local food systems |

| Exercise | Reward users for regular physical activity | Fitness benefits require long-term effort; participation may decline once incentives cease | Incentivise building and maintaining community fitness infrastructure like public exercise parks | Creates lasting community assets that benefit broader population over time |

| Eco-shopping | Reward sustainable product purchases | Limited to immediate purchase impact; consumer habits and production issues remain unchanged | Incentivise investment in local, sustainable businesses with verifiable environmental practices | Strengthens sustainable business ecosystem and drives systemic change in production |

| Donation | Reward users for contributing funds to environmental causes | Impact depends on recipient organization's effective use of funds | Focus on funding long-term infrastructure like renewable energy or reforestation | Creates physical assets with ongoing environmental benefits beyond initial funding |

Beyond economic viability concerns, many ReFi X2E models incentivize short-term regenerative activities that address symptomatic ecological and social issues, rather than tackling the underlying causes. True planetary regeneration necessitates addressing the root problem of extraction, a capacity in which current ReFi X2E models are largely ineffective.

Case study: Sweatcoin

Sweatcoin, established in 2014, is a pioneering "move-to-earn" (X2E) project that incentivises physical activity by rewarding users with sweatcoins for their steps. With a current user base of 190 million, it stands as the oldest sustainability-focused X2E platform. Its unique position, operating within both Web2 and Web3 ecosystems, provides a valuable case study for understanding the challenges and limitations inherent in X2E projects.

Revenue models

Sweatcoin combines three revenue models: commission marketplace, freemium, and ads. It operates a marketplace where brands pay for promotional space to target health-conscious users, driving the majority of Sweatcoin redemption for users. Additionally, Sweatcoin offers premium subscriptions that accelerate Sweatcoin earning rates, and supplements its income with intermittent in-app Google advertisements for the freemium user. In 2022, Sweatcoin launched the Sweat Economy and the SWEAT cryptocurrency.

As of 2023, Sweatcoin has amassed 140 million registered users, with a major surge in 2022—65 million new users—coinciding with the launch of its SWEAT cryptocurrency. However, app downloads dropped from 60.2 million in 2022 to 23.9 million in 2023, a 60% decline, corresponding with the drop in $SWEAT value from its ATH of $0.09148 in 2022 to $0.0111 in 2023.

Finances

From 2018-2023, Sweatcoin has generated an average of $12 million in annual revenue with the revenue per user per year standing at $0.11 which is actually very low. In most app-based business models, even a freemium app with light monetization could pull $1–3/user/year, which would be $140M–$420M/year at their user scale.

Sweatcoin faces significant monetization challenges despite its large user base, primarily due to a concentration of users in low-ARPU emerging markets where ad revenue and in-app spending are minimal. This circles back to my point that the most users of X2E projects are likely those that can depend on the rewards as supplementary income.

Additionally, the app experiences high user churn and low engagement, with many users downloading it for initial free tokens and then abandoning it. Furthermore, the scaling of brand deals, a core revenue stream, is lagging behind user growth, particularly as many users reside in regions where partner brands have limited presence.

Given these factors, Sweatcoin's current revenue generation is likely below its potential. The platform is under-monetizing its user base, and if it fails to improve user engagement and conversion through strategies such as $SWEAT token adoption, enhanced partnerships, or premium features, it risks substantial revenue loss.

The way forward

In my mind, ReFi X2E projects lack the economic and impact viability to exist as standalone projects. They could either rely on external funding, integrate with projects that have economic viability, or better still, pivot to building an economically viable product.

External funding - VeBetter

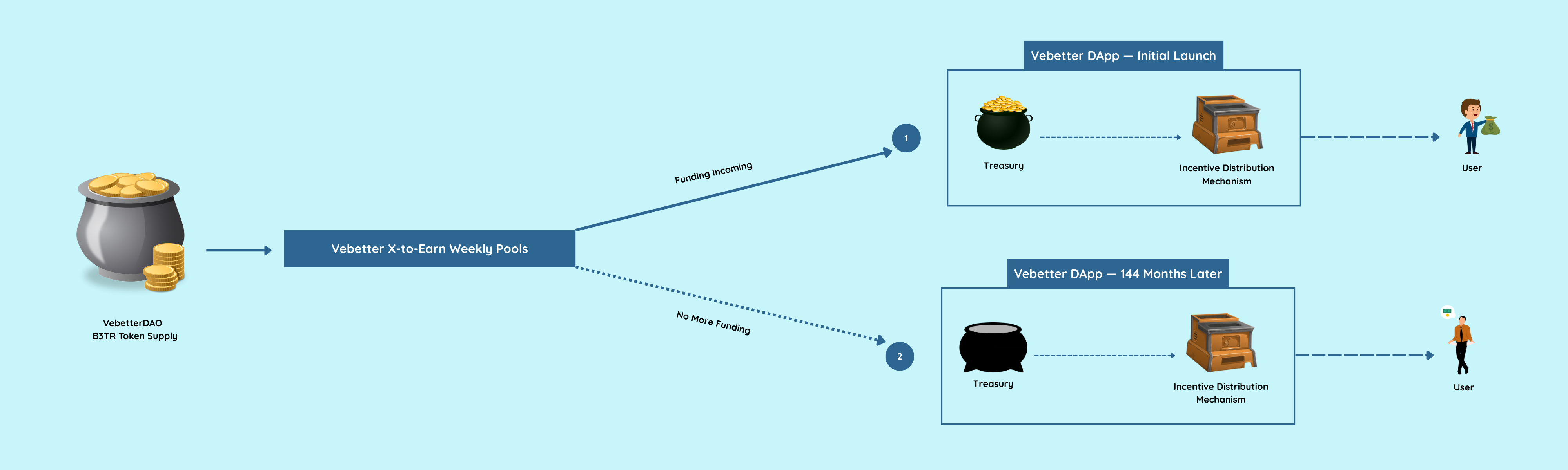

A poster example providing external funding for ReFi X2E projects is VeBetter. You can think of VeBetter as a build-to-earn project that incentivises the building and development of ReFi X2E products in the VeChain ecosystem.

VeBetter uses a percentage of its B3TR token supply to fund X2E Dapps weekly and will continue to do so for the next 10-12 years. My major problem here is that like any other X2E model discussed, VeBetter relies on its token supply to fund these regen projects without any means of replenishment. VeBetter presents an innovative approach to funding sustainability, but its long-term sustainability (<20 years) is not guaranteed.

Some X2E projects on VeBetter include, Scoop-Up rewards users for cleaning up animal waste, promoting cleaner public spaces. Cleanify encourages proper waste management by incentivising area cleanups, addressing the root cause of litter. EVearn promotes the adoption of electric vehicles by rewarding users for charging them.

Pivoting

The most sustainable path forward may be pivoting to create products with inherent economic viability that generate ecological and social benefits as a core feature, not an add-on for people to earn from. Consider a "Cultivate-to-Earn" X2E model focused on regenerative agriculture. Current models often reward farmers solely for planting, potentially leading to short-term engagement and limited long-term sustainability.

However, a pivoted approach would be a regenerative agriculture project leasing plots to smallholder farmers and providing continuous monitoring of crop growth to ensure healthy yields. A plant-to-earn model in this context could attract farmers who are genuinely interested in the offering and willing to invest in it, while also incentivising them to begin planting as soon as they acquire their plots. Even after the planting rewards stop, the farmers are likely to continue growing crops due to the low cost of leasing and the added value of crop monitoring.

The key pattern in successful pivots is identifying specific friction points in existing markets where environmental solutions offer competitive advantages. This might require analysing current offerings to determine which components generate the most customer interest. For instance, if the original ReFi project included IRL community meetups for move-to-earn projects that customers find particularly valuable, rebuilding around this capability rather than the X2E concept is likely to generate more economic value.

Conclusion

ReFi X2E projects are excellent for driving user adoption and attention, but they often struggle with sustainable funding because their value propositions don’t align with traditional revenue models. Additionally, the activities they reward tend to generate only short-term impact. As standalone products, they currently fall short in effectively incentivising and achieving long-term impact. However, they work best in ReFi when used to attract users to economically viable projects, steadfastly driving the regenaissance.

This article represents the opinion of the author(s) and does not necessarily reflect the editorial stance of CARBON Copy.