For all its benefits, our current financial system has one fatal flaw: the prioritisation of profit over everything else, including the environment.

It has led to the grinding inequality, environmental degradation, and climate change that threaten our very existence as a species. That isn’t hyperbole. If we continue down our current path, the next century will present existential risks that we are simply not prepared for. Islands will be swallowed whole, urban air will be too toxic to breath, and water will become a resource worth killing for.

It sounds bleak because it is. The thing about capitalism, though, is that it doesn’t have to entail such a ruthless pursuit of profit. There is a path in which profit, humanity, and the environment can co-exist; a path in which we are incentivised to ensure that all three benefit from our financial and investment decision-making.

That path is regenerative finance.

Emanating from the concept of regenerative economics, regenerative finance is an approach to finance and investment that aims to support the regeneration of ecological, social, and economic systems. It recognises that the traditional financial system has prioritised short-term profits at the expense of long-term sustainability and resilience.

“ReFi”, as the Web3 implementation of regenerative finance has come to be known, is grounded in this concept. It is a new pathway for solving old problems; one that reimagines how we value the environment and the people within it. But, critically, ReFi is not a panacea, nor necessarily feasible as an alternative to our current financial system. It is however a core piece of the much larger, collaborative effort that is required at all levels to address systemic issues such as climate change and income inequality.

What is ReFi?

The seeds of ReFi can be traced back to the launch of Bitcoin in 2009, when, for the first time, infrastructure for a decentralised, alternative financial system was publicly realised. Ethereum’s launch in 2015, which introduced the concept of smart contracts and tokenisation, provided the tools to build services on top of this infrastructure. It was then only a matter of time before this same infrastructure and tools were leveraged for ecological and social impact.

In its most basic form, ReFi represents a belief that our current economic and financial system needs to change if we are going to address our systemic issues, and that this new system needs to be decentralised, equitable, and regenerative, not centralised, unjust, and extractive.

At a more practical level, ReFi can be described as Web3-powered ecological and social impact. In other words, taking the available Web3 solutions—blockchain, cryptocurrency, smart contracts, and decentralised autonomous organisations (DAOs)—and combining them with other modern technologies to build solutions that address our systemic issues.

Some examples include:

- Digital measurement, reporting, and verification (dMRV) of ecological credits

- Low-interest micro-lending platforms

- Circular economy projects

- Ecological credit marketplaces

- Climate data oracles

- Universal basic income schemes

- Social impact verification

- Public goods funding mechanisms (quadratic, retroactive, et al)

These solutions are the beginnings of the alternative financial system that underpins ReFi’s existence. And while not always fully regenerative in scope, ReFi solutions are bound together by the need for fundamental change.

Key characteristics

Digging deeper, ReFi has some notable characteristics that build upon our definition:

- Prioritises a systems thinking approach to ecological and social impact by appreciating nature’s and society’s interconnectedness.

- Espouses a culture of proactivity over reactivity.

- Values coordination and collaboration over competition.

- Provides a bridge to a regenerative system.

- Integrates modern technologies such as artificial intelligence (AI), Internet of Things (IoT), and mobile payment services.

What ReFi aims to achieve

At a more granular level, ReFi aims to:

- Bridge the financing gap for climate change mitigation, adaptation, and loss and damage (currently estimated in the trillions of dollars).

- Fund public goods

- Address income inequality and economic injustice.

- Provide a decentralised alternative to the opaque, inefficient voluntary carbon market and MRV process.

- Issue new currencies backed by the value of ecological assets.

- Reform the way land is valued based on its ecological value.

- Aggregate funds for lending to small-scale regenerative projects that larger institutions typically ignore.

- Provide regenerative investment instruments that balance regeneration and return.

- Incentivise healthy habits such as diet, exercise, mindfulness, and “inner regeneration”.

How ReFi adds value

One of the most frequently asked questions, and one people in the space have had trouble articulating an answer to, is how ReFi adds value to the fight against climate change and income inequality. The ubiquitous blockchain attributes—transparency and immutability—are often touted but are rarely valuable in isolation. (The “garbage in, garbage out” metaphor comes to mind.)

Instead, we think it more helpful to look at other aspects that make ReFi solutions viable, as it may turn out that Web3 is not the long-term technological and/or philosophical foundation:

- Hyperlocal focus. A core tenet of most ReFi projects is real-world grassroots impact. Instead of building solutions that can scale globally, what we have seen in ReFi is a tendency towards solving local problems first. This philosophy aligns closely with the idea that financing is most effective when distributed directly to individuals or communities. It also allows ReFi solutions to battle-test their ideas at a small scale before deciding whether to expand.

- Agility. Web3 technologies have reached a level of maturity where they are fairly easy to integrate into real-world services. ReFi solutions are able to get up and running quickly, begin testing, and then rapidly adapt to changing dynamics on the ground.

- Decentralised ethos. As the evolution of AI demonstrates to mainstream audiences the need for decentralised governance, the idea that the Global Commons could be governed in any other way is becoming increasingly infeasible. ReFi has decentralisation built in by design, meaning that the solutions that come out of the space are inclusive in nature and developed in the open source.

- New incentive frameworks. Incentives are perhaps the most critical aspect of human and organisational behaviour. In our current system, incentives are aligned towards profit, which means a vast majority of the effort and capital go towards making profit at the expense of everything else. ReFi aims to fund and instil new incentive frameworks that give people the luxury to prefer regeneration over exploitation. In other words, where impact equals profit.

How ReFi works

At its core, ReFi works in three primary ways:

- Facilitates the flow of funding and incentives from source to end user via decentralised services and treasury governance mechanisms

- Provides end users with data-driven tools to derive financial value from regenerative practices

- Supports the issuance of new currencies and investment instruments backed by tokenised ecological assets

A key point is that ReFi solutions often integrate existing technologies, such as AI, mobile payment networks, and sensors, to maximise usability. These technologies are not always decentralised, but they are necessary for adoption. Consider the case of rural farmers in Kenya as an example. Mobile money is the most commonly accepted digital payment medium in the country. A ReFi solution that involves sending money to these farmers should leverage mobile money, not expect to onboard the farmers to cryptocurrency payments..

A ReFi model in action

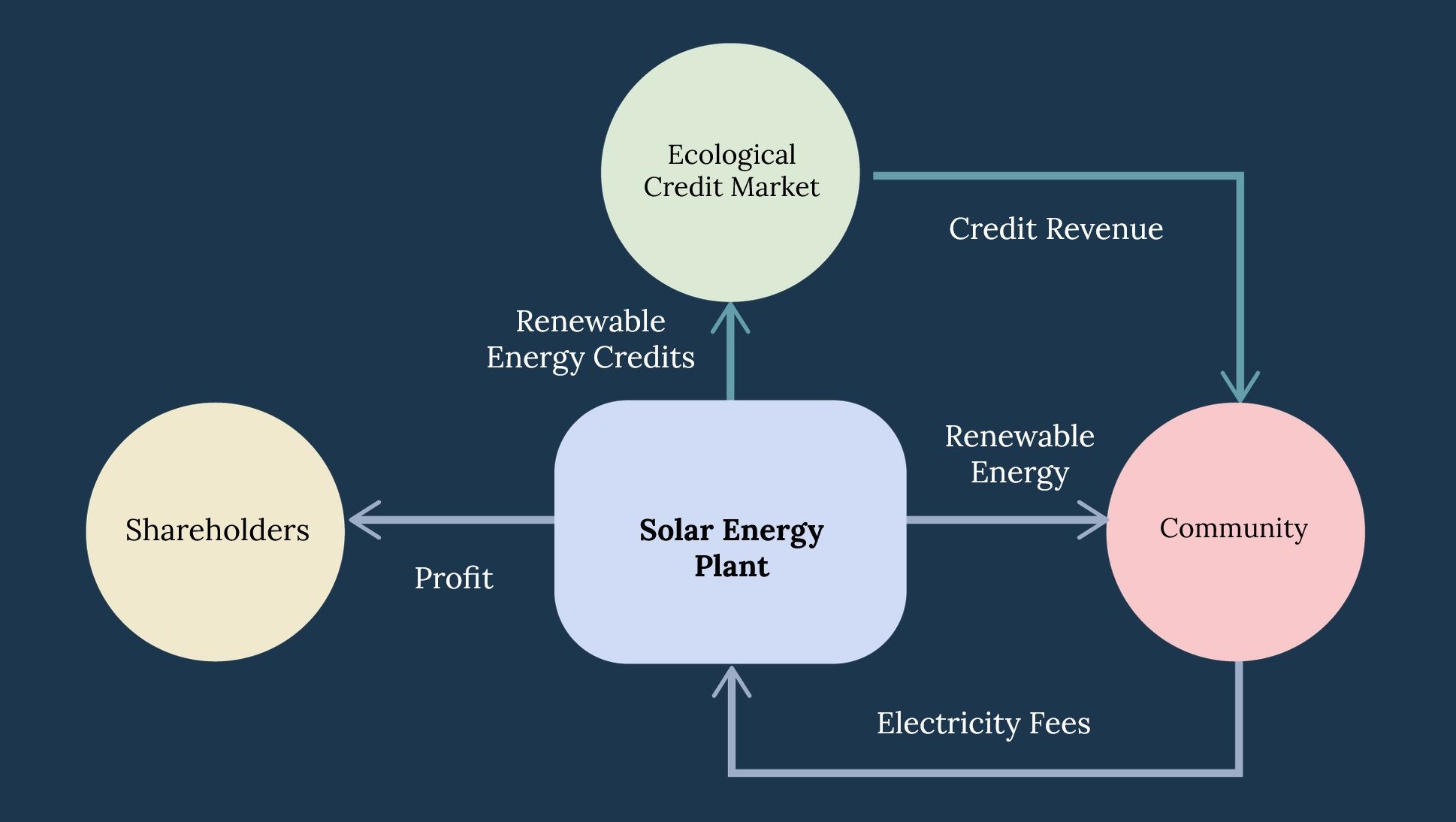

A good example of a ReFi system built on regenerative principles is a solar power plant that uses the income from the sale of renewable energy credits to improve the surrounding community instead of pocketing it as profit above and beyond the profit already made from operating the plant.

ReFi and Web3

Web3 is both an enabler and a limiting factor for ReFi. It is the infrastructure that underpins much of what ReFi holds dear but it has so far struggled to deliver at scale in the real world. A big reason for that is because it requires more participation, more steps, and more awareness, which rarely align with actual on-the-ground needs. Important progress is being made on this front, however, such as the ability to secure a wallet with credentials from Google, Facebook, and others instead of having to rely on private keys.

The reality is that the decentralisation, transparency, and democratisation desired by ReFi is an end. It is the result of a long, iterative process in which these elements are introduced according to need, not foisted upon end-users. There is also the industry’s obsession with native utility tokens as the primary means to facilitate economic activity in a solution’s own ecosystem. While cheap to mint and distribute as rewards, these tokens are far too volatile and, regardless of their tokenomics, lose their value during bear market cycles. This is not a sustainable model. Stablecoins, by contrast, are a much more appropriate medium of ReFi-driven economic activity.

It remains unclear if Web3 technologies such as blockchain, cryptocurrency, and DAOs are the long-term answer. They are the best option for the moment, but many ReFi solutions who have had success in the past couple of years have actually decreased or eliminated their reliance on Web3 in order to meet the needs of the market. And while this may sound like a harbinger of doom, we would argue that it is a sign of maturity. It is projects recognising that Web3 is not a solution in itself, but rather tools to be applied when they are the best fit for a particular need.

It is safe to say that ReFi has proven itself as a viable solution in the fight against climate change and income inequality. And while impact remains relatively small and localised, there are real people on the ground benefitting from this new approach to finance. We also cannot help but remark on the ingenuity and passion of the people in the space. It is refreshing to see blockchain and cryptocurrency demonstrate their utility outside of the investment realm. There is, however, a long way to go before ReFi becomes anything close to what it aspires to be.