As soaring temperatures, raging wildfires, and other extreme weather events paint a painful picture of our environmental crisis, green bonds are considered an effective tool for helping developing countries mitigate and address the impact of climate change. But promising as they are, challenges such as greenwashing, limited impact, and debt trap risk have made some experts question their efficacy. In this article, we explore the green bond concept, who is eligible, the advantages and disadvantages, market growth, and look to the future.

What are green bonds?

Green bonds are debt securities issued to raise capital for environmental and sustainability projects. Issued by multilateral banks and organisations such as the World Bank, they enable governments and projects to access targeted climate funding by appealing to investors focused on positive ecological impact.

As with any debt security, green bond investors are repaid over time with interest. Borrowers typically fulfil their debt obligations with revenue or savings generated from the projects they needed the debt financing for. As a result, green bonds are sometimes considered to be a win-win for all involved, including the climate.

Who is eligible?

Eligibility criteria plays a pivotal role in ensuring the transparency and authenticity of environmental projects. These criteria provide a framework to assess the alignment of projects with sustainability objectives, which bolsters investor confidence and the effectiveness of capital allocation. The following broad categories have been created to identify eligible projects:

- Renewable energy - Example: a company seeking to build a wind farm can issue green bonds to finance turbine installation and repay bondholders using revenue from energy sales.

- Energy efficiency - Example: a municipality aiming to enhance its energy efficiency by retrofitting public buildings can issue a green bond and repay bondholders using the energy savings.

- Sustainable waste management - Example: a company can issue green bonds to finance a modern recycling facility and repay bondholders with revenue from recycled material sales.

- Sustainable land usage - Example: a conservation group can issue green bonds to conserve and regenerate ecologically important land and repay bondholders with the revenue from carbon credit sales

- Biodiversity conservation - Example: an organization can issue green bonds to fund the protection of endangered species and repay bondholders with revenue from sustainable tourism and research collaborations.

- Sustainable water management - Example: a city can issue green bonds to revamp water systems and repay bondholders with savings from increased efficiency and polluter fines.

- Climate change adaptation - Example: a coastal town can issue green bonds to defend against rising sea levels and storm surges while repaying bondholders with funds earmarked for disaster recovery.

In recent years, 19 emerging market governments, from Chile to Uzbekistan, have leveraged green bonds to fund environmental projects in order to better align with Sustainable Development Goals (SDGs). India has also launched a $2bn green bond for climate initiatives encompassing mitigation, adaptation, environmental protection, resource conservation, biodiversity, and net-zero objectives.

Advantages

When utilised correctly, green bonds offer several advantages:

- Environmental impact - Green bonds direct capital towards eco-friendly projects, such as renewable energy, sustainable infrastructure, and climate adaptation, promoting positive environmental change.

- Investor appeal - Investors seeking to align their portfolios with sustainability goals find green bonds attractive, potentially expanding the investor base and diversifying funding sources.

- Transparency - Issuers must disclose project details, enhancing transparency and accountability, which fosters investor trust and credibility.

- Sustainability leadership - Issuing green bonds showcases an issuer's commitment to environmental responsibility, positioning them as leaders in sustainability.

- Green innovation - Green bond projects can drive innovation, advancing technologies and practices that address environmental challenges.

Disadvantages

Green bonds also come with some disadvantages, however, that must be considered before a borrower chooses green bonds as its financing mechanism or an impact investor decides to invest:

- Greenwashing - Projects and issuers can mislead investors by overstating or fabricating environmental benefits.

- Standardization challenges - The absence of uniform green bond standards can lead to inconsistency in project evaluation and interpretation.

- Limited impact on global challenges - While green bonds advance specific projects, they tend to have limited impact on larger systemic issues like global carbon emissions.

- Cost and complexity - Meeting disclosure and reporting requirements can be expensive and complex, which can act as a deterrent for smaller projects with fewer resources.

- Debt trap - Projects unable to fulfil their debt obligations can end up having to borrow more money in order repay bondholders, landing them in a debt trap.

Market growth

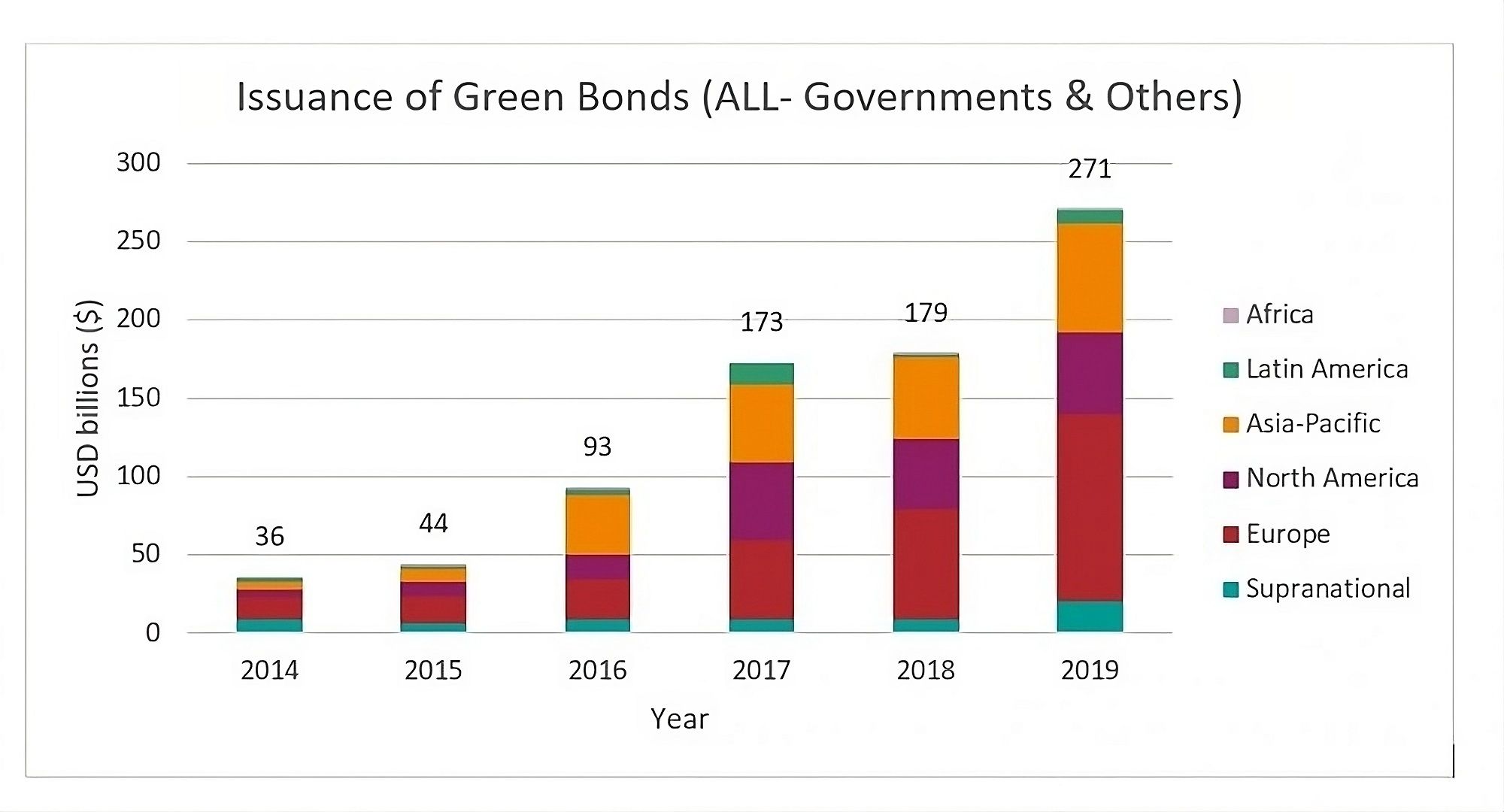

Research suggests that the green bond market has grown from about $36bn in 2014 to $271bn in 2019.

This trend has been driven by an increasing number of countries embracing green bonds. As an example, Germany entered the arena by introducing a $6.5bn green bond in September 2020.

Future outlook

The future of green bonds holds promise and challenge in equal measure. As the urgency of the climate crisis intensifies, the green bond market is expected to continue its expansion, attracting a broader spectrum of issuers and investors. However, navigating the growing complexity of the market, ensuring demonstrable impact, and ensuring borrowers avoid the debt trap remain hurdles.

Regulatory bodies are likely to play a crucial role in standardising criteria and enhancing transparency, mitigating the risk of greenwashing and promoting investor confidence. Moreover, as climate risks become more pronounced, green bonds could evolve to address broader systemic concerns and social issues, fostering a more holistic approach to sustainability.

Ultimately, the trajectory of green bonds hinges on the collective efforts of projects, governments, financial institutions, and investors to create a trusted and effective financing instrument that helps mitigate, adapt to, and repair damages from the climate crisis.