Climate finance is considered by many to be a crucial tool in the fight against climate change. Not without its fair share of detractors, however, it runs the risk of falling well short of its potential. In this article, we'll look at what climate finance is, how it works, its benefits, key concerns, current trends, and future outlook.

What is climate finance?

Climate finance refers to the funds and resources allocated to address climate change-related challenges and promote sustainability. Its primary goal is to support the transition to a low-carbon, climate-resilient global economy, while playing a pivotal role in achieving the objectives set forth in international agreements like the Paris Agreement and the UN's Sustainable Development Goals.

Climate finance serves three main purposes:

- Mitigation - Investing in projects and initiatives that reduce greenhouse gas emissions, such as renewable energy development, energy efficiency improvements, and afforestation projects.

- Adaptation - Supporting communities and nations in adapting to the impacts of climate change, including building resilient infrastructure, protecting coastal areas from rising sea levels, and implementing drought-resistant agricultural practices.

- Loss and Damage - Addressing loss and damage caused by climate-related events, such as hurricanes, floods, and droughts. This funding is particularly important for vulnerable communities that lack the resources to cope with severe climate impacts.

How does it work?

Climate financing plays a crucial role in addressing climate change because it helps countries and organizations implement climate-related projects and transition to a low-carbon, climate-resilient economy. Here's how it works:

- Funding sources - Financing comes from both public (governments, international organisations, international development banks) and private (banks, private equity funds, businesses) sources.

- Instruments - Climate finance usually comes in the form of grants, loans, equity investments, green bonds, and carbon credits.

- Implementing organizations - International financial institutions (the World Bank), national and multilateral development banks, and climate funds (Green Climate Fund and The Climate Investment Funds) are primarily responsible for overseeing the disbursement of climate funding.

- Project selection and implementation

- A wide range of projects are eligible, such as renewable energy installations, reforestation efforts, sustainable agriculture, and climate-resilient infrastructure.

- Projects are selected based on their potential to reduce emissions, enhance climate resilience, and contribute to sustainable development goals.

- Once funded, projects are implemented according to approved plans, with regular monitoring and evaluation to track progress and ensure funds are used effectively.

- Reporting and transparency - Recipients and implementing organizations are required to provide regular reports on project performance, financial expenditures, and emissions reductions achieved.

- Results and impact assessment - Evaluations are conducted to assess the impact of funded projects and their contribution to climate goals.

Benefits

Climate finance offers a number of benefits that make it a critical tool in the fight against climate change:

- Economic opportunities - Investment in climate projects stimulates economic growth and increases employment opportunities, specifically for affected communities.

- Wealth transfer - Public financing helps to address global inequality through wealth transfer from developed to developing countries.

- Private sector engagement - Carbon credits and climate startups mobilize capital from the private sector.

- Innovation - Access to venture funding encourages technological innovation aimed at solving the big climate problems.

- Green incentives - The entire sector provides incentives for sustainable development over exploitative development.

Concerns

In spite of the benefits, there are a few big concerns that threaten the credibility of the entire climate finance sector:

- Massive funding gap - Estimates suggest that some $1 trillion annually will be needed to fight climate change. Current funding levels are somewhere between $20 and $80 billion. Questions remain about whether developed countries have the will to pay for the damage they’ve inflicted on the climate.

- Preference for loans over grants - Developed countries often prefer loans over grants, which places a significant burden on developing countries.

- Debt trap – Developing countries taking on loans to fight climate change can fall into a debt trap where they continually need to borrow more in order to pay back existing obligations.

- Too many big venture bets – Venture funds place too big an emphasis on climate tech startups solving huge global problems. This means too much private money goes to these high-risk, high-reward bets that fail a vast majority of the time.

- Erosion of climate assets – Some experts suggest that relying on financial mechanisms alone will ultimately result in failure. True climate solutions should prioritise the preservation and restoration of natural ecosystems.

Market growth and funding gap

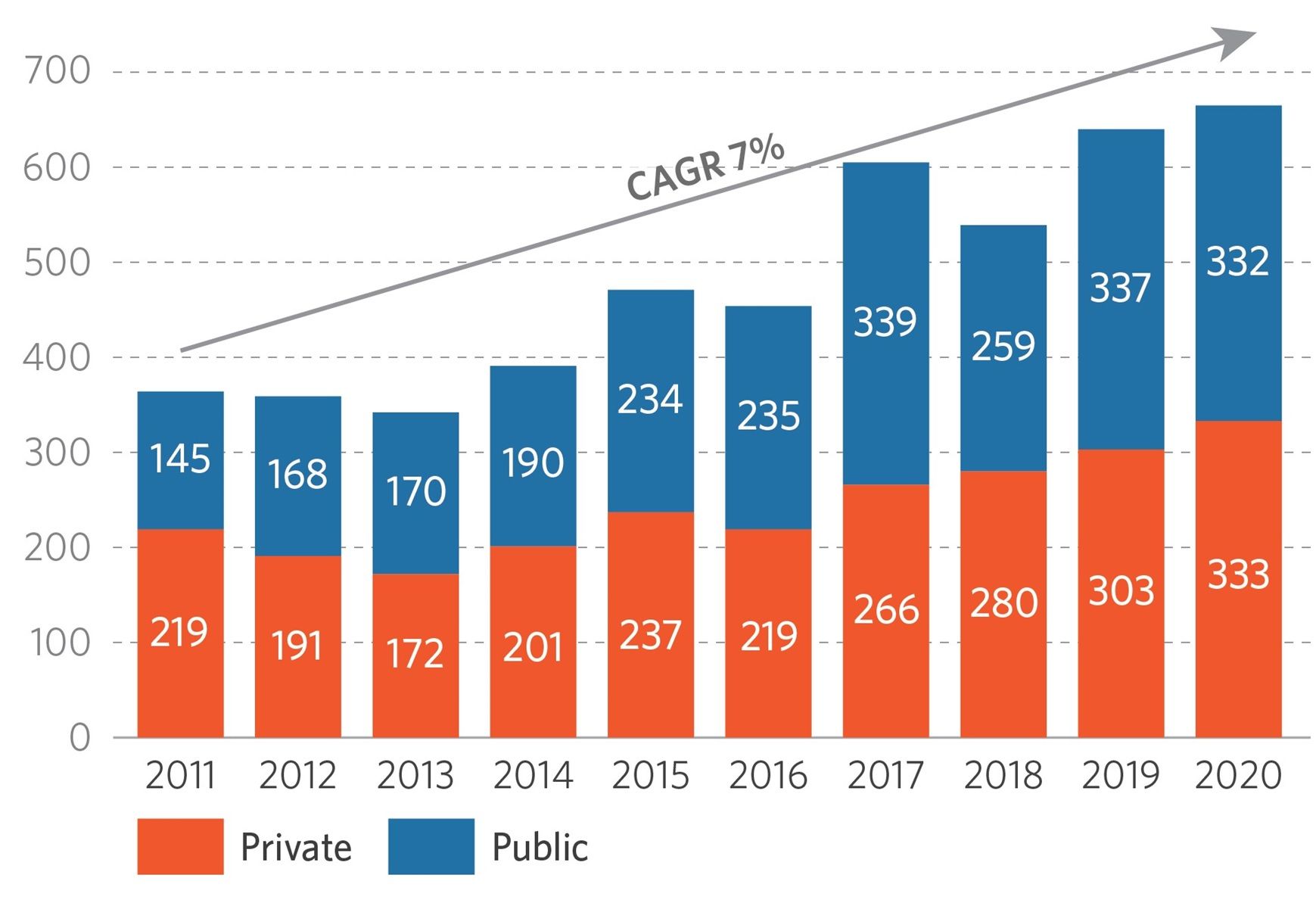

(Source: Climate Policy Initiative)

In the last decade, global climate finance nearly doubled. $4.8 trillion was committed from 2011 to 2020, an average of $480 billion annually. Despite this 7% annual growth rate, the current pace falls well short of aligning with a 1.5°C global warming scenario. Estimates suggest at least $4.3 trillion per year is needed by 2030, which translates to a 21% annual growth rate.

Private financing grew at a slower rate (4.8%) than the public sector (9.1%) and must scale up rapidly. While the public sector plays a crucial role in directing finance to critical sectors like agriculture and climate change adaptation, there's ample room for the private sector to invest in the technologies and projects that can achieve climate impact at scale. Innovations such as electric vehicles, lab-grown meat, carbon capture, reforestation, and soil regeneration.

Future outlook

To ensure that climate finance can scale to meet the demands of climate change, several key factors are likely to shape its trajectory:

- More funding - Easily the most critical factor is the urgent need to bridge the funding gap through increased public and private commitments.

- New funding mechanisms - Beyond more funding, innovative funding mechanisms need to be explored that incentivise conversation and regeneration.

- Climate change adaptation - Mitigation is important, but more attention and funding needs to be given to climate adaption initiatives that help countries and communities adapt to the effects of climate change.

- Retain investor participation - Retail investors and their significant aggregate wealth need to be presented with better financial instruments to invest in the climate.

- New technologies - Solutions based on technologies such as Web3 and AI have already showed potential, especially at the community level, to scale impact.

- Climate safety net - Fintech solutions, such as anticipatory cash transfers, need to be implemented to lessen the impact of climate events on those most affected.

- Public pressure - Public pressure on governments and financial institutions to do more before its too late needs to be ramped up.

Overall, questions remain about who is responsible for meeting the demand for climate finance. The most poignant question may be the degree to which developed countries should pay their fair share for the damage they've done to the climate. Given the clout of these countries in international affairs, it remains to be seen how willing they will be to both reduce emissions at home and pay for the damage they've already done to the climate.