My Take on the MycoFi Book

Is it the future of finance as the authors suggest?

By Trinity Morphy | April 2nd, 2024

When I first encountered the word "MycoFi," I assumed it was a scientific discovery. I spoke to a colleague and we cracked jokes about it. Due to a congested schedule, I didn't Google it and forgot about it. Two weeks ago, this friend sent me an e-book entitled Exploring MycoFi: Mycelial Design Patterns for Web3 and Beyond by Jeff Emmett and Jessica Zartler. He claimed it to be a central source of truth on the subject.

Skimming through the book, I laughed at my previous nerdy scientific notions. I had expected MycoFi to portray a complex scientific idea: a "propitious genomic variation, governed by the Byzantine genomic complexity, driving profound evolutionary bifurcation and perpetuating monumental divergence phenomena." Instead, the concept was relatively simple: a new crypto financial system emulating the design patterns of the mycelial network.

Two exciting concepts stood out: the abstraction of DeFi, ReFi, and CoFi through MycoFi and the Wood Wide Web. (Throughout the millions of years I had spent on Earth (pun intended), this was my first time encountering a WWW unrelated to the internet.) These two concepts propelled me to read the book from cover to cover. This article recaps all I learned from the book, my reservations about the potential of this new system, and areas that I need clarification on.

MycoFi, as I understand it

The term MycoFi originated from Jeff Emmett and Scott Morris in 2023. As the name suggests, it combines collaborative finance (CoFi) and mycelial networks. MycoFi isn't just about making money but creating a healthier economy. It encourages us to work together like mushrooms in a forest instead of separating ourselves. Like mushrooms growing after a fire, MycoFi can help us heal the damage caused by our economy. It inspires us to think differently about money and develop new ideas.

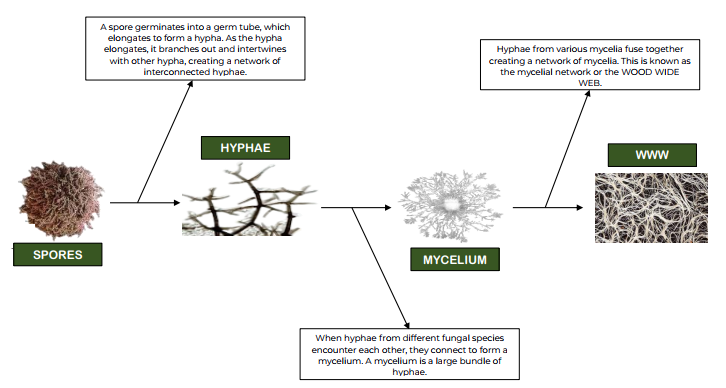

The Wood Wide Web

The Wood Wide Web is a network beneath the forest floor connecting trees and plants. This network isn't made of wires like the internet but tiny fungal filaments. The fungal filaments, called hyphae, weave through the soil and connect to the roots of many different trees. The fungi get sugars from the trees, and the trees get water, nutrients, and minerals that the fungi help them absorb from the soil. This web can link up many trees, helping them share resources and stay healthy together. The Wood Wide Web paints a picture of a hidden world where trees are interconnected through a fungal network, facilitating the exchange of resources for a healthy forest ecosystem.

DeFi + ReFi + CoFi = MycoFi?

For context, I'll briefly define the Fi's in question. CoFi is a system where community members utilise blockchain-based trust networks to extend credit, lend, borrow, and transact. Decentralized finance (DeFi) refers to disintermediated financial services built on smart contracts. Web3 Regenerative Finance (ReFi) uses blockchain and cryptocurrency to create positive social and environmental impact.

To my understanding, MycoFi is an attempt to restructure these three separate Fi's into a single unified crypto-economic model leveraging the design patterns of a mycelial network. The idea of MycoFi is to abstract away the attachment of existing crypto-economic models to Web3 products. In other words, no more "ABC is a DeFi protocol built on XYZ that enables DEF," but rather "ABC enables DEF." For example, it isn't important for a user to differentiate between a website, a web app, and a decentralised web app (Dapp). What matters is what they're able to do with them.

MyCoFi aims to achieve this level of uniformity but with DeFi, ReFi, and CoFi. To illustrate using the structure of the mycelial network, think of MyCoFi as the component directly visible to the naked eye. DeFi, CoFi, and ReFi provide all of the connectivity and functionality beneath the surface.

Potential use cases

The book highlights a couple of use cases which I found interesting, if somewhat confusing.

Endosymbiotic finance

Endosymbiotic finance proposes a scenario where organisations don't need loans or outside investors to grow. Instead, they generate their financial power internally, like how cells produce energy with mitochondria, by providing goods or services to stakeholders in their ecosystem. These could be customers, clients, suppliers, or even employees. Revenue earned from this activity is then used to back the issuance of their own currency.

Collective flourishing by expanding expressivity

A mouthful, this describes a concept where community currencies, each representing different values, can be components of a larger interconnected economic system. They are designed to reflect what's important to each community, so when people transact with them, they support their beliefs.

Consider Greenfield and Harmony Hills, two towns with their own local currencies: GreenCoins and Harmony Bucks. GreenCoins are earned through eco-friendly activities, while Harmony Bucks are earned through wellness activities. These towns are part of a larger network where residents can exchange their community currency for those of other communities. Additionally, additionally these currencies can be integrated into financial services such as time deposits and lending.

Is MycoFi the future of finance?

I still can't wrap my head around the actual goal of MycoFi. DeFi aims to democratise financial services, ReFi aims to foster resilience and regeneration, and CoFi aims to emphasise community-driven financial systems. Common amongst all three is a concrete aim. MycoFi lacks that. Its only benefit is the supposed efficiency gained from the mycelial design pattern. A distinct feature needs to be provided to builders and users to expand its adoption.

People naturally resist change and will only succumb if the benefits are more significant than what the previous system offered. Bitcoin, the first DeFi application, offered people a way to carry out financial transactions without intermediaries like banks. Yet, people kept ignoring the technology until they saw its value surge. When there's no demand for a product, it is natural for it to die out, and I fear that for the MycoFi movement.

Conclusion

MycoFi is all about using the principles of mushrooms to change our economy, eliminating parts that don't work anymore, and making something new and better. It's like a song calling us to be a part of evolution and connect instead of separating. Just as mushrooms help forests recover after fires, MycoFi shows how we can come together to fix the problems in our society through a healthy economy.

My primary school teachers always discussed the disadvantages and advantages of any topic taught. This lesson has stuck with me and I apply it to any discourse. In this case, the authors overemphasise the advantages, benefits, and impact of the MycoFi system. Far less attention is paid to the disadvantages and unintended consequences that may arise. Namely, is it realistic to assume that we can jump straight to MycoFi when we haven't yet mastered DeFi, ReFi, and CoFi?

Despite my reservations, I look forward to following the evolution of MycoFi. I just hope the authors and other proponents aim for objectivity and aren't afraid to answer the hard questions.

This article represents the opinion of the author(s) and does not necessarily reflect the editorial stance of CARBON Copy.