Collaborative Finance for Regen Collectives

Trinity Morphy dives into an unheralded approach to grassroots finance and lays out potential solutions for regen collectives.

By Trinity Morphy | May 13th, 2025

Web3 regen collectives today are vehicles for gathering people enthusiastic about ecological and social impact. Unfortunately, some of these collectives—large as they may be—lack the financial resources to efficiently operate, talk less of sustainably funding impact initiatives. So, when the Regen Coordination council published the GG23 Regen Coordination Global round results on May 8th, I was both happy and concerned.

I was happy because over 30 regen collectives received grant funding. I was concerned because the amount each individual collective received, between US$1,000-US$3,000, is not enough. Because these collectives are mostly unprofitable, they rely on donations to survive—an unpredictable revenue stream. In the pursuit of revenue predictability, what can these collectives do in the medium term to drive revenue and still achieve impact? My answer is Collaborative Finance (CoFi).

This article explores why CoFi is best suited as a business approach for regenerative collectives, highlights CoFi models they can implement, shares success stories from those already leveraging CoFi, and offers an outlook on CoFi as a tool for economic impact for local communities and revenue generation for regen collectives.

Why is CoFi suitable?

CoFi is a financial approach where people, communities, or organisations work together to pool resources, share risks, and make collective decisions about money and investments. CoFi is arguably the best business approach for regen collectives because it ties profit directly to social impact in the communities in which they operate. A successful CoFi approach would stimulate local economies while driving profits for these collectives, earning them greater acceptance and respect in their local communities. The collectives, in turn, could leverage these mutual acceptance to: onboard more community members who will donate during grant rounds, increase matching funds, bring in additional capital to circulate within the local economy, and ultimately generate more revenue.

More specifically:

Local community onboarding

The overarching goal of regen collectives is to power local regenerative economies—village-based systems that support human well-being, social cohesion, and ecosystem health, enabling people to thrive in harmony with each other and nature. At the grassroots level, we can only achieve this vision by onboarding the locals and CoFi offers tangible value to attract them, such as access to pooled capital for building businesses. As trusted and respected individuals join, others are more likely to follow, making trust a key driver of adoption and operations.

Capital retention and revenue generation

CoFi systems keep money circulating within local communities rather than flowing out to external financial institutions. As onboarded locals access and utilise pooled capital in the form of low-interest loans for their businesses, they generate returns that will enable them repay their debts, making the capital available for the next business owner. Most CoFi systems are economically viable, and when implemented effectively, they generate income for the regen collectives which obviously goes back to supporting local businesses. This cycle keeps capital within the community and supports the continued growth of the economy.

TVF accumulation

Total Value Flowed (TVF) is a way to measure how much capital stays and moves within a local Web3 economy, instead of being converted to fiat and leaving the system completely. Monty Bryant introduced this idea in his Ethereum Localism article as a way to track how well regenerative communities keep value circulating to support local impact and drive long-term sustainability. Right now, most regen collectives financially operate a one-way flow with no structure in place for that money to cycle back in. CoFi systems, which are naturally circular, allow capital to move between the treasury and the local economy. By utilising CoFi as a business approach, these groups can enable a circular flow and improve their TVF.

Value alignment

CoFi is a natural match for the values and goals of existing regen collectives. It supports financial decentralisation and helps build resilient alternatives to extractive economic systems. Its flexibility makes it a great choice of implementation in rural communities. Using CoFi in practice is a proof of work showing the better financial future these groups are working toward.

CoFi implementations

CoFi systems are inherently flexible, because their operational structures are typically shaped by the cultural, economic, and social dynamics of the grassroots communities they are implemented in. While CoFi systems can vary widely, they are generally characterised by four core qualities: collective governance, trust infrastructure, inclusive access, and capital circulation. For the context of this article, we will be focusing on CoFi systems a regen collective can implement and onboard members of the local community into.

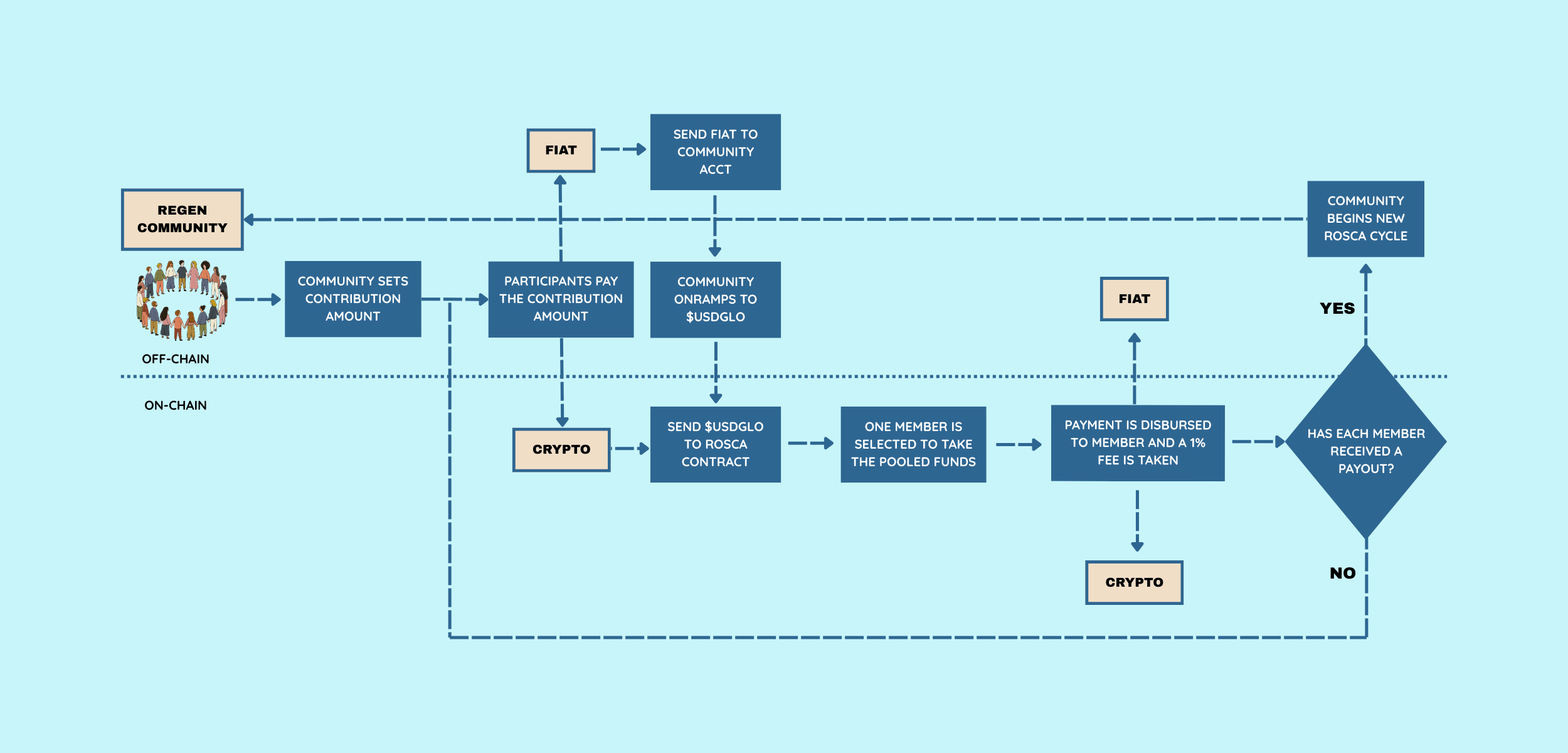

Rotating Savings and Credit Association (ROSCA)

A Rotating Savings and Credit Association (ROSCA) is a system where a group of people agree to contribute a fixed amount of money into a shared fund at regular intervals (weekly or monthly). At each interval, the total pooled amount is given to one member of the group, rotating until every member has received the lump sum once.

Rules and member contributions

Before contributions begin, the regen collective agrees on a fixed contribution amount. This standardizes the cycle and ensures that all participants are contributing equally throughout the process. If a member prefers to pay in fiat, they send the stipulated amount to the group’s bank account upon which it is converted to $USDGLO and deposited into the ROSCA smart contract. Alternatively, if the member prefers to use crypto, they directly send $USDGLO to the ROSCA smart contract.

Locking and distribution

Funds sent to the ROSCA smart contract are locked and remain inaccessible until the preset unlock date arrives. On the unlock date, the ROSCA contract releases the assets to be given to the designated member in the payout rotation. The regen collective gets to keep 1% of the unlocked funds for operations. If the recipient prefers crypto, the funds are sent to their digital wallet. If they prefer fiat, the funds are off-ramped into the community’s bank account and then transferred to the member’s local bank account.

Ongoing contributions and completion

After the payout, the cycle continues as all members keep contributing their set amounts. The next member in the rotation becomes the new recipient in the following payout round. This process ensures that each member receives the pooled funds in turn. Once every member in the group has received their payout, the current ROSCA cycle is considered complete. At this point, the regen collective can begin a new ROSCA cycle, either using the same structure or making changes based on the group’s evolving needs.

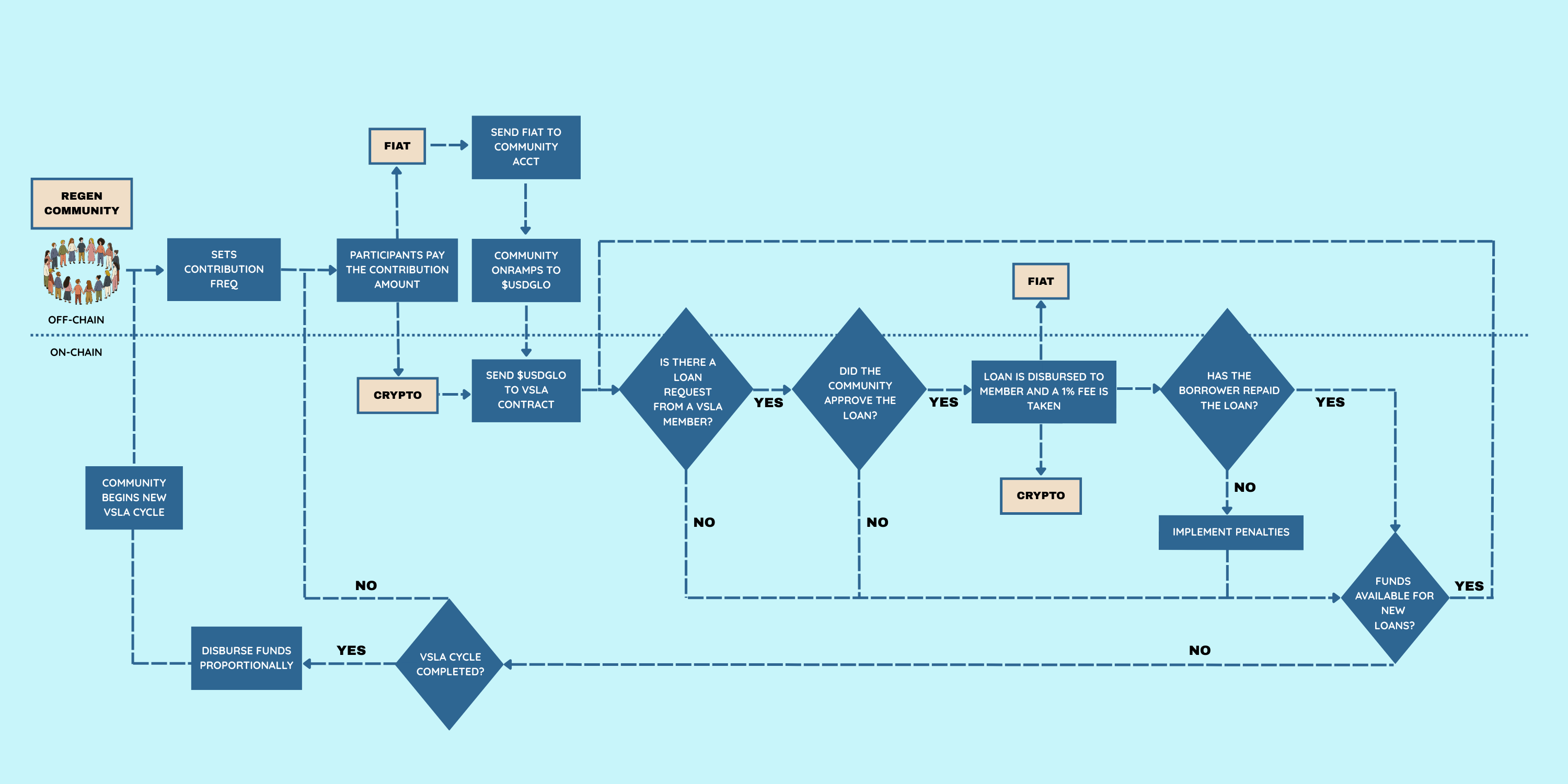

Village Savings and Loan Association (VSLA)

A Village Savings and Loan Association (VSLA) is a community-based financial system where a group of people voluntarily come together to regularly save money into a shared fund. Unlike a ROSCA, where the pooled money is distributed to one member at a time in rotation, a VSLA allows members to save collectively and borrow from the group's fund at agreed interest rates. Loans are repaid with interest over time, and at the end of a set cycle (usually 9–12 months), the total savings plus earned interest is distributed among members based on how much each person saved.

Rules and member contributions

The regen collective establishes lending rules, including interest rates, penalties, and the contribution frequency. Each member contributes to the treasury based on the set frequency, either in fiat or cryptocurrency. If a member prefers to pay in fiat, they send the stipulated amount to the collective’s bank account upon which it is converted to $USDGLO and deposited into the VSLA smart contract. Alternatively, if the member prefers to use crypto, they directly send $USDGLO to the VSLA smart contract.

Loan disbursement

Members can choose to request loans from the pooled funds, and each request is subject to review and a vote for approval or denial by all participants in the VSLA. If a loan is approved, a 1% fee is deducted for the regen collective from the requested loan amount, and the remaining funds are disbursed directly to the member’s wallet or bank account.

Loan repayment

Loans are repaid on the agreed date, and when a member repays, both the principal and interest are returned to the VSLA contract. In cases of default, preset penalties are enforced. At the end of the VSLA cycle, all funds in the contract including profits are redistributed proportionally to the members, and a new cycle begins.

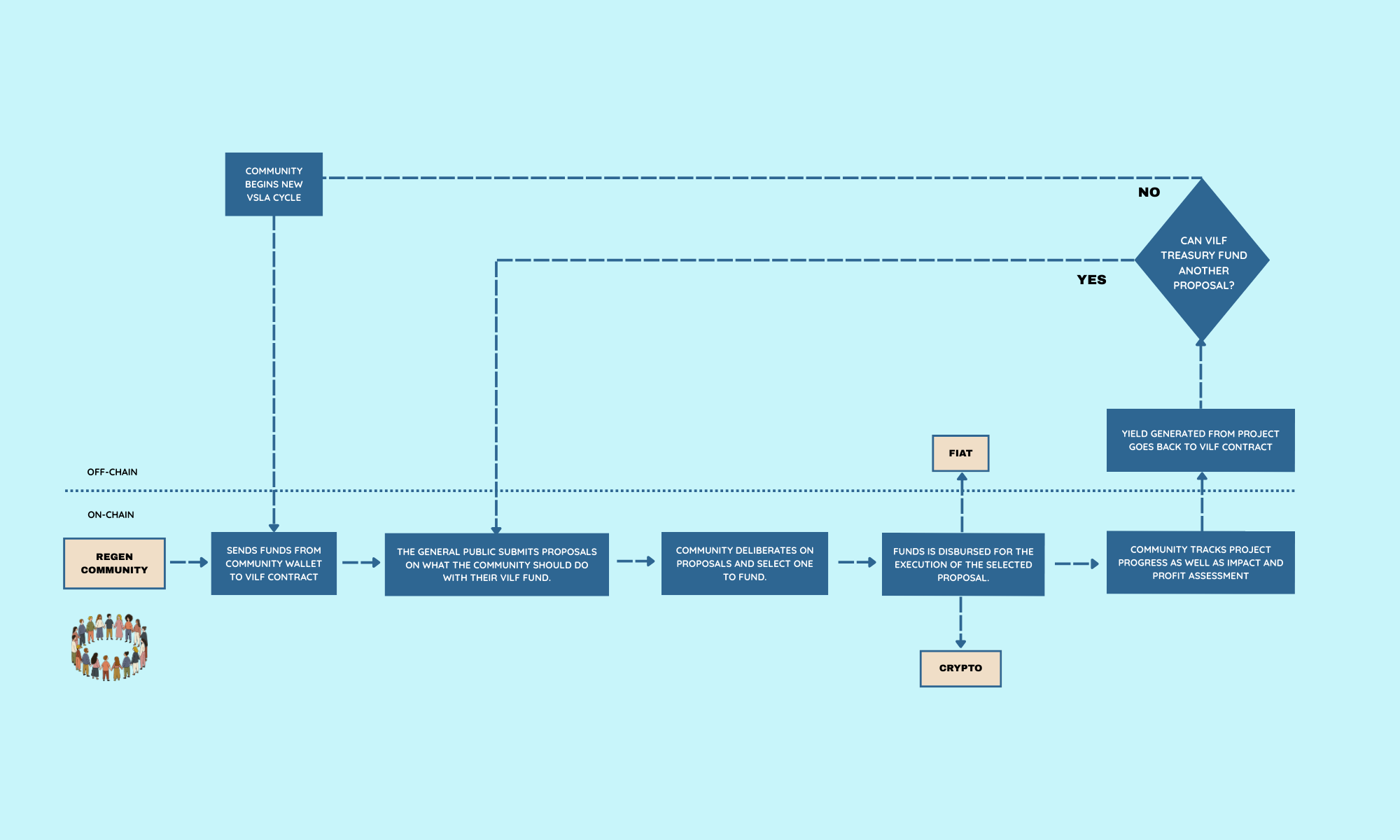

Village Investment and Loan Fund (VILF)

A VILF is a financial mechanism where members of a village or local group contribute money into a shared fund at regular intervals, such as weekly or monthly, with the goal of supporting income-generating projects and community development. The fund is managed collectively and used to provide loans to members for small businesses or farming activities—often at low or no interest—as well as to invest in shared assets like farming equipment, storage facilities, or clean energy tools that benefit the entire village. Additionally, the fund may support broader community needs such as healthcare, education, or infrastructure. Repayments and profits from these investments are returned to the fund, increasing its value and enabling continued support for new initiatives.

Capital commitment

The regen collective commits a portion of its treasury to support the VILF.

Proposal selection and funding

The group will open a submission window for proposals. These may include small business development plans from members or infrastructure-related initiatives. Submitted proposals will be evaluated based on their medium-term economic viability, ability to balance impact with profit, and potential to generate returns for the community. After review, one proposal will be selected for funding per cycle, while others may be reconsidered in future rounds. The selected proposal will receive funding from the VILF treasury to enable efficient execution.

Project monitoring and reporting

The regen collective will oversee and report on the progress of funded projects. For small businesses, this involves tracking business growth and repayment capacity. For infrastructure projects, the focus will be on development milestones and the benefits delivered to the local community.

Return on investment

Profits generated from funded projects will be returned to the VILF treasury. These returns will be used to support future proposals and collective initiatives.

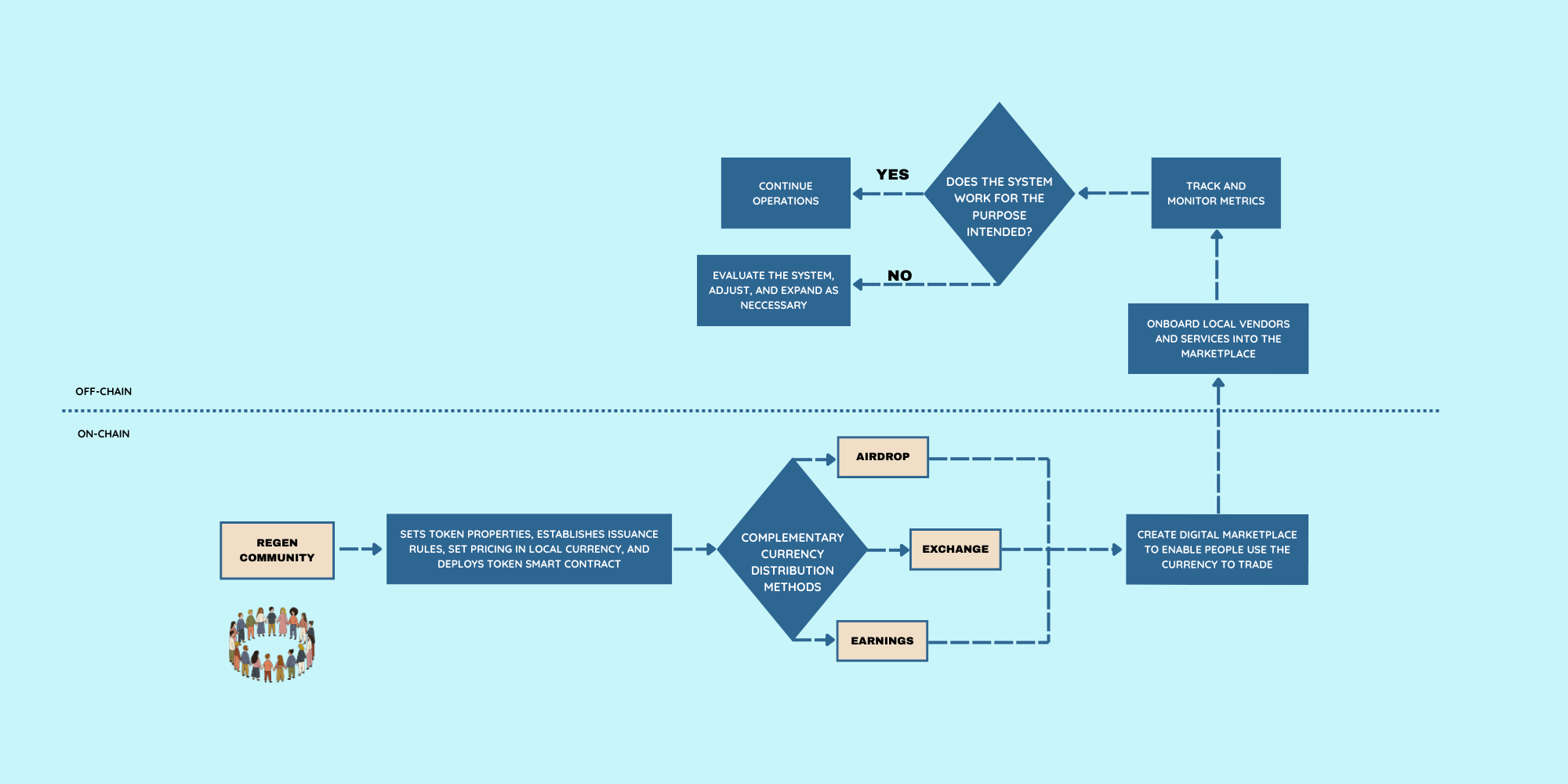

Complementary Currencies

A complementary currency is a form of exchange designed to work alongside a national or fiat currency. They serve to fulfill functions that national currencies often neglect like strengthening local economies, incentivising value-aligned behaviour, or facilitating transactions in communities with limited cash flow.

Currency design

The regen collective initiates a complementary currency system by first designing the currency. This includes selecting a name and unit for the currency, setting the properties of the token, and establishing the rules for how the currency will be issued. Once these elements are in place, the community deploys the currency through a smart contract.

Distribution and earning

After the smart contract is deployed, the next step is to distribute the currency. This can happen through airdrops, exchange mechanisms, or enabling members to earn the currency through regen activities. These distribution methods ensure that the currency begins to circulate within the community. With currency in circulation, the community integrates it into a digital marketplace. This involves creating an online platform, onboarding local vendors and service providers, and setting prices in the new local currency. This integration is essential for giving the currency real utility and encouraging adoption.

Monitoring and evaluation

Ongoing monitoring and governance help ensure that the system continues to serve its intended purpose. Collective members track key metrics and evaluate whether the system is functioning effectively. If not, adjustments and expansions are made as needed. When the system is deemed effective, operations continue, and the cycle of use and improvement repeats.

A CoFi example

ReFi Medellín operates a community-focused credit platform that issues low-interest loans in $USDGLO. As of the latest data, 19 loans have been issued from a $15,000 USDGLO pool, with 8 successfully repaid.

How does this system benefit ReFi Medellín?

- Local community onboarding - To access the loans, members must own a ReFi Medellín community NFT, attend at least three community events, and receive endorsements from three existing members that own the ReFi Medellín NFT.

- Capital circulation and generation - With a 0.5% interest rate, the loans are easily accessible making them accessible for needs such as healthcare, education, and daily living expenses. Instead of capital leaving the ecosystem, funds remain within the community circulating locally.

- Value alignment - ReFi Medellín’s lending model prioritizes genuine community needs and ensures that resources are used to support essential services rather than personal gain.

- Total Value Flowed (TVF) - When those loans are repaid, the capital returns to the treasury, ready to be redeployed. This creates multiple cycles of value from the same funds. With eight loans already repaid, the platform has successfully demonstrated its ability to recapture value and sustain internal growth. Each lending cycle increases total value flow without the need for constant outside capital.

Outlook

CoFi models are powerful business approaches for regen collectives to achieve self-sufficiency and strengthen local economies. While a few pilots such as ReFi Medellín have validated the potential of these systems, widespread adoption remains a dream. To scale CoFi in local communities through regen collectives, here are three key focus areas:

-

Increased experimentation - Regen collectives should be encouraged to pilot various CoFi models based on their specific local contexts. Even small-scale experiments can help refine operational strategies and build confidence in these models' effectiveness.

-

Infrastructure for deployment - It may be tough to implement these financial models using web3 technologies because of the need for a smart contract expert to build the tech and they don’t come cheap. Since most regen collectives can't afford this, the Regen Coordination Network could create ready-made tools for some of these models. Then, communities could easily use and implement them without needing their own developers.

-

Trust as a bug and feature - Trust is key for CoFi to work. People need to believe others will act fairly for the group to succeed in sharing risk and making decisions together. But trust can also cause problems if it's not earned. If there aren't enough rules or ways to check what's happening, dishonest people can take advantage of these systems and hurt everyone. The challenge here is to implement these systems in ways that encourage trust but also have safeguards to prevent things from going wrong, keeping the system fair and reliable.

Ultimately, the more we normalize and circulate CoFi tools within and beyond regen collectives, the more we can build financial systems that are inclusive, sustainable, and regenerative by design. These systems won’t just generate income, they’ll cultivate resilient, value-aligned economies from the ground up.

This article represents the opinion of the author(s) and does not necessarily reflect the editorial stance of CARBON Copy.